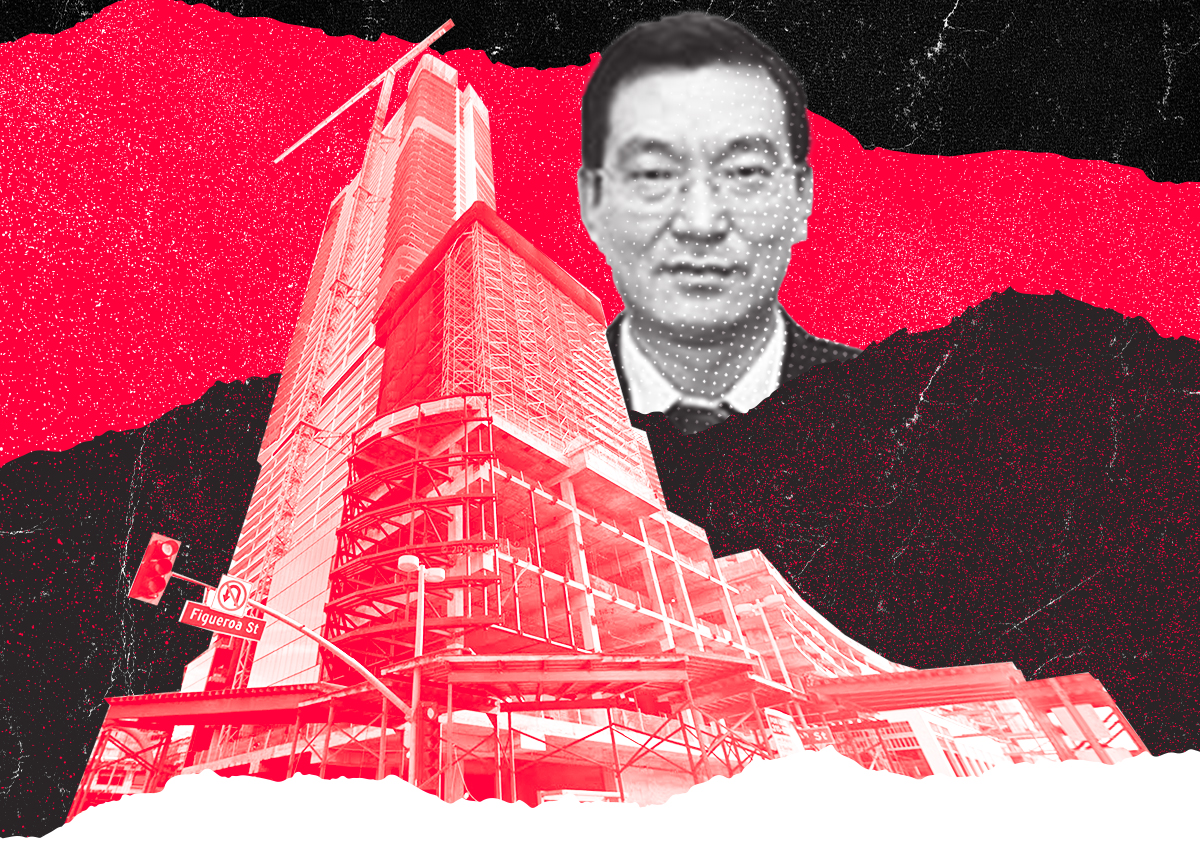

The China-based developer behind the massive boondoggle of Oceanwide Plaza in Downtown Los Angeles has dealt with the ire of city officials lately, thanks largely to vandals who have left the development’s unfinished floors covered with colorful tagging.

Now Oceanwide Development has another hurdle: bankruptcy.

A group of creditors filed for involuntary bankruptcy on the Oceanwide Plaza project earlier this month, according to bankruptcy court records. Through the petition, creditors can attempt to force a person or institution to pay off owed debts by forcing them into bankruptcy.

Lendlease, Standard Drywall, Star Hardware, Woodbridge Glass and Mitsubishi Electric claim Oceanwide owes contractors on the 2 million-square-foot, three-tower project a total of $4.3 million for unpaid work, according to the bankruptcy claim. That amount was confirmed in legal stipulations and agreements stemming from other litigation.

In separate litigation, courts have said Oceanwide owes Lendlease a lot more. In 2021, Oceanwide was ordered to pay $42 million to Lendlease, which was once the general contractor on the project, for unpaid work and breaching contracts.

The involuntary bankruptcy petition is merely a hiccup compared to the overall financial issues facing the project and its parent company.

China Oceanwide has said it would need more than $1.2 billion to finish its Downtown L.A. project, where worked stopped in 2019, according to filings with the Hong Kong Stock Exchange. The company has already spent $1.1 billion on the project, located at 1101 Flower Street, across from the Crypto.com Arena.

China Oceanwide, the parent company, has been delisted from the Shenzhen Stock Exchange, after its stock price dropped below the exchange’s threshold price of 1 RMB (about 14 cents in USD).

As of Sept. 30, China Oceanwide reported that its liabilities were nearly double its assets, “indicating severe insolvency,” Yicai Global, a China-based business publication, wrote.

Oceanwide was subject to “administrative measures by the [China Securities Regulatory Commission’s] Beijing branch in January for repeatedly failing to disclose its debt defaults in a timely manner.”

The U.S. bankruptcy petition could force an asset sale, just to recoup debts owed to the contractors.

Oceanwide has tried for years to sell the Downtown L.A. property, though sources who have been approached and considered an acquisition say the costs of finishing the project are too great.

Right now, the City of Los Angeles is most concerned with cleaning up graffiti sprayed across the 27 floors, which sit open to the elements and are visible from surrounding towers.

Last week, the City Council voted to spend $3.8 million to secure the property and clean up the graffiti.

“The purpose of my motion is clear: to prepare our city to take decisive action if the Oceanwide Plaza developer ignores their responsibility and to put them on the hook for costs incurred by the city,” Councilman Kevin de León, who proposed the motion, said at the time.

The city attorney is also looking into a legal strategy to recoup the funds from Oceanwide.

Whether the city will be successful is unclear. Other creditors and contractors have not been.

Read more

The post Contractors aim to push Oceanwide into bankruptcy appeared first on The Real Deal.

Powered by WPeMatico